Creating Winning Trading Strategies with TradingView Alerts

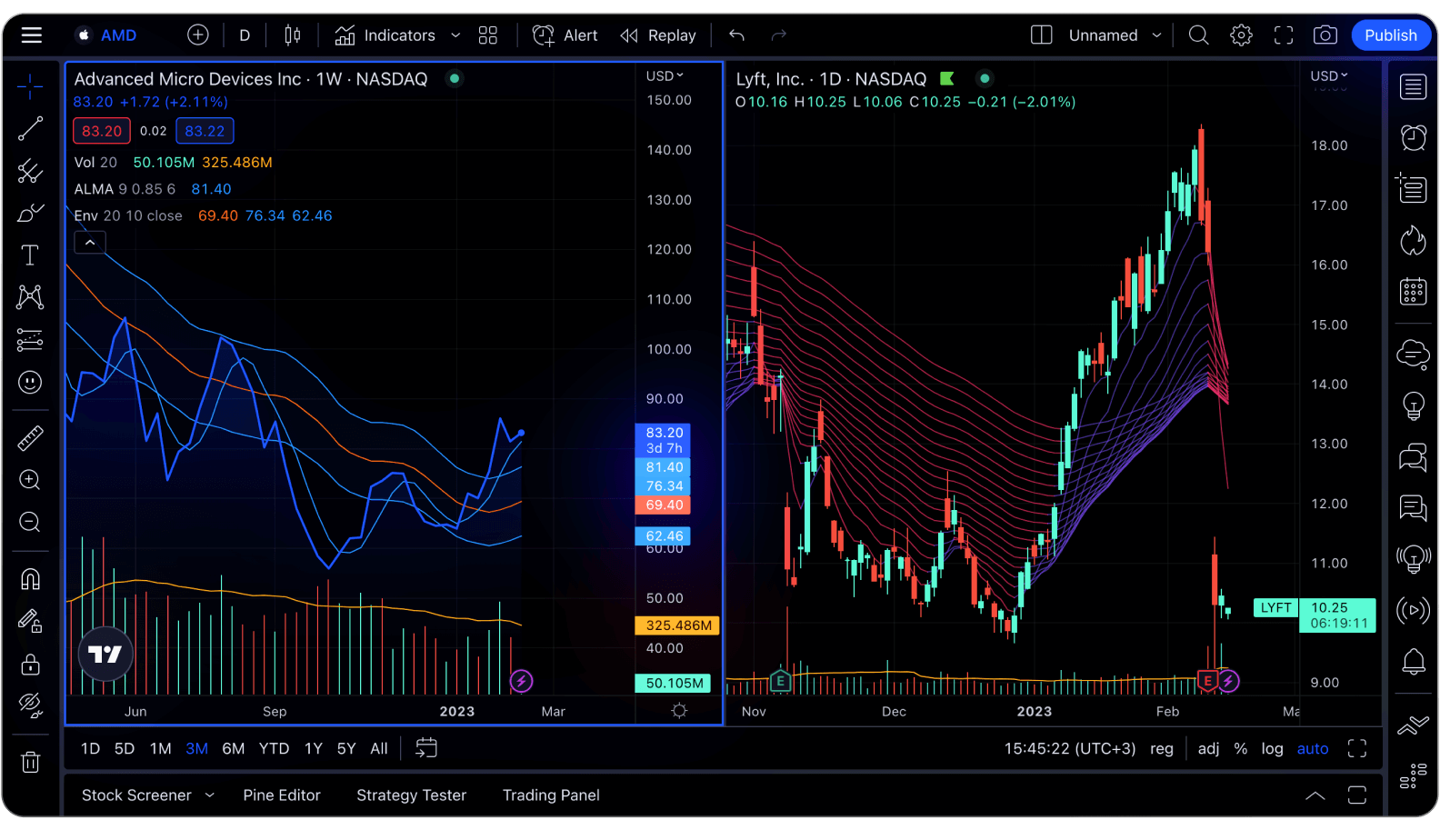

TradingView, a well-known graphing and investigation stage, offers a hearty, ready framework that can be a useful asset for merchants trying to make and execute winning trading procedures. Makes on TradingView permits brokers aware of mechanized portions of their trading interaction, remain informed about economic situations, and jump all over chances without steady observing. We’ll look at how to use TradingView alerts to create and implement successful trading strategies in this article.

Figuring out TradingView Cautions:

TradingView cautions are warnings set off by unambiguous economic situations or cost levels that you set ahead of time. If your broker integrates with TradingView, these alerts can be sent via email, SMS, pop-up notifications, or even executed orders. Check more on free demat account Here are the moves toward make and use cautions really:

Identify Your Trading Plan:

Prior to setting up cautions, you really want an unmistakable trading procedure. Settle on the rules that will set off your activities. You might want to set up alerts for, for instance:

Breakouts: Inform me when the cost crosses a key opposition level.

Moving Normal Hybrids: Alert me when the 50-day moving normal crosses over the 200-day moving normal. Check more on free demat account

Oversold/Oversold Conditions: Send a ready when the General Strength List (RSI) comes to 70 (overbought) or 30 (oversold).

Make Alarms on TradingView:

To set up TradingView alerts:

Open the diagram of the instrument you need to exchange.

Right-click on the outline at the value level or marker condition you need to set off the caution. Check more on free demat account

“Add Alert” can be found in the context menu.

Modify the ready settings, including the kind of condition, ready activities, and warning strategy (email, SMS, and so on.).

Backtest and Refine:

Whenever you’ve set up your cautions, it’s critical to backtest your procedure to guarantee it lines up with your trading objectives. See how your strategy would have performed in the past by utilizing the alert conditions and historical data. Refine your risk management rules and alert conditions if necessary.

Carry out Hazard The executives:

Coordinate gamble the executives into your trading methodology. Decide your position size, stop misfortune, and take benefit levels in view of your gamble resistance and the resources you’re exchanging. TradingView cautions can assist you with executing these gamble the executives control naturally. Check more on free demat account

Screen and Change:

Indeed, even with computerized cautions, checking your exchanges and the market is fundamental. Conditions might change, and unforeseen occasions can affect your positions. Prepare to make any necessary adjustments or cancel alerts.

Benefits of Utilizing TradingView Cautions:

Time Productivity: TradingView alerts save you time and let you trade multiple assets at once because you don’t have to constantly look at the charts. Check more on free demat account

Control of Emotions: Mechanization diminishes profound direction, which can prompt hasty exchanging.

Precision: Alarms can be set with accuracy, guaranteeing you don’t miss explicit economic situations or open doors. Check more on free demat account

Customization: TradingView considers exceptionally adaptable cautions, obliging different trading procedures and styles.

Diversification: With cautions, you can exchange a different scope of resources and techniques, taking care of various economic situations and open doors. Check more on free demat account